E-commerce insights for home and garden brands in 2024

Uncover the trends shaping the behaviours of recent movers, the strategic importance of mental availability in brand discovery, and the role of targeted communication in crafting effective marketing strategies for the home and garden sector.

A distinct market segment emerges within the ‘mover’ category, presenting a significant opportunity for brands in the home and garden sector. What makes this market segment particularly compelling is their substantial spending; averaging around £42,000 (Source: TwentiCi) on goods and services in the crucial months surrounding their move.

Recognising and speaking to the unique needs and preferences of this market segment during their home-buying journey is pivotal for developing an effective marketing plan.

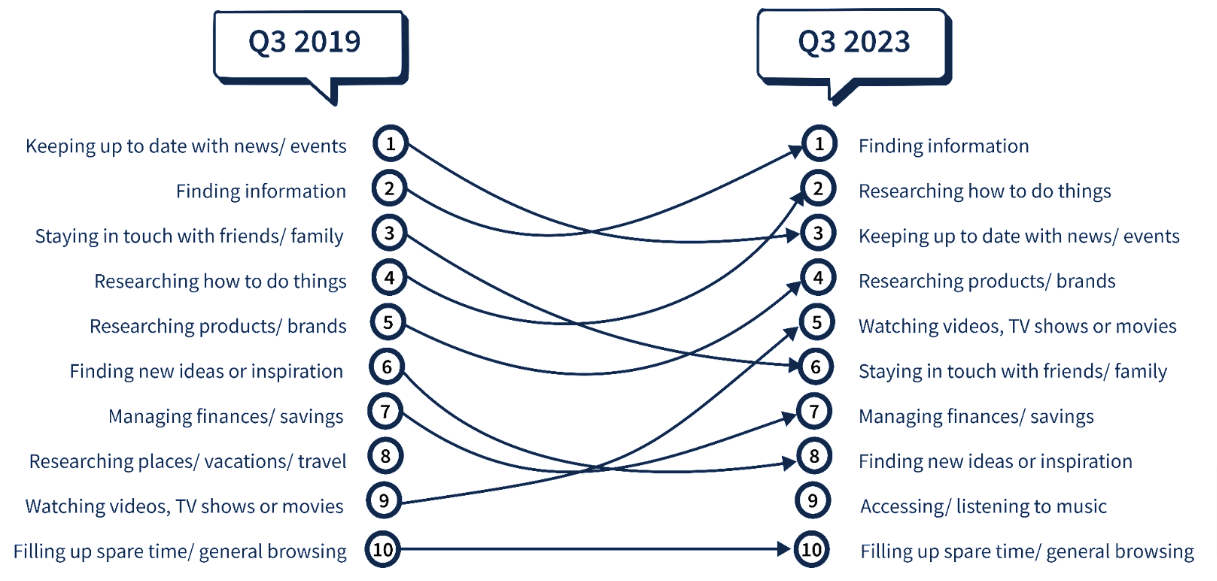

Online consumer behaviour within the home mover segment

As we navigate the evolving digital landscape, a significant shift is observed during the ‘learning stage’ of potential consumers within the home mover segment. While finding information remains paramount, there has been a notable decline of 8% in consumer engagement in researching products online since 2020.

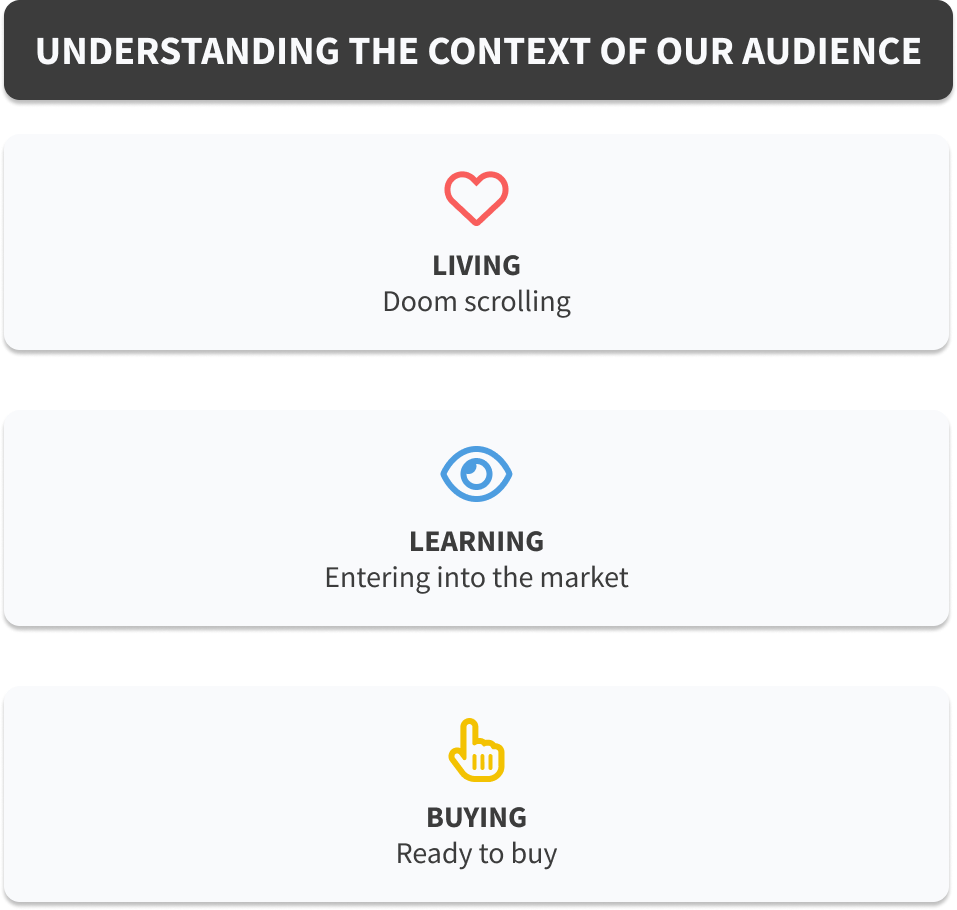

A note on ‘Living, Learning, Buying’

Inspired by Byron Sharp’s principles, our communication framework recognises the diverse nature of customers and the necessity to comprehend their context for structured communications. Understanding their immediate purchasing intent or future consideration is crucial for building mental availability to drive consideration in the moments that matter.

Trends specific to recent movers

A nuanced exploration of the behaviours of recent movers in suburban and rural areas, particularly those interested in DIY, home improvements and gardening, reveals intriguing trends within this market segment.

- Search for knowledge: an 8% increase in ‘how to do things’. Recent movers are increasingly turning to online platforms to seek guidance on ‘how to do things,’ indicating a growing interest in practical, hands-on information rather than just product specifics.

- Declining interest in product research: -7% in researching products/brands. Contrary to the broader market trend, recent movers within this segment are showing a decline in interest when it comes to researching specific products or brands before making a purchase decision.

- Inspiration takes a back seat: -7% in finding new ideas/inspiration. The desire for inspiration is waning among this market segment, with a 7% decrease in consumers actively seeking new ideas or inspiration for their home and garden projects.

What we can learn from 2023

Brand discovery – Living

In the Living phase, consumers are immersed in the flow of their daily lives, not actively seeking out brands. However, certain channels naturally contribute to brand discovery as they go about their routines, here it is important to build mental availability.

| Brand Discovery: Top 5 | Audience % |

| Search engines | 44 |

| Word-of-mouth recommendations from friends or family members | 44 |

| Ads seen on TV | 42 |

| Online retail websites | 39 |

| Ads seen on social media | 39 |

Online product research – Learning

Transitioning to the Learning phase, consumers become more intentional in seeking information about products and brands as their interest is piqued. Understanding and conveying category entry points become crucial during this phase.

| Online product research: Top 5 | Audience % |

| Search engines | 65 |

| Consumer reviews | 52 |

| Product/brand sites | 41 |

| Price comparison websites | 37 |

| Social networks | 28 |

Online purchase drivers – Buying

In the Buying phase, consumers are ready to make decisions and specific factors become paramount in influencing their online purchases.

| Online Purchase Drivers: Top 5 | Audience % |

| Free delivery | 77 |

| Coupons and discounts | 53 |

| Reviews from other customers | 45 |

| Quick/easy online checkout process | 44 |

| Easy returns policy | 38 |

Takehomes: The power of relevance

Segmenting our audience based on variables such as behaviours, attitudes and interests enables relevance in defining who they are and is key to crafting relevant messages that resonate and effective media plans that work for your budget.

Ready to learn more? Join us at our next Decoding Digital event for insightful content delivered in-person with our team of experts!

-

03.10.2022|You can’t improve what you don’t measure…

03.10.2022|You can’t improve what you don’t measure… -

14.07.2023|Can understanding the interplay between System 1 and System 2 thinking and incorporating creativity into our marketing strategies cultivate emotional connections?

14.07.2023|Can understanding the interplay between System 1 and System 2 thinking and incorporating creativity into our marketing strategies cultivate emotional connections? -

21.08.2023|Have you ever wondered how you can better understand your audience and create more impact with your marketing?

21.08.2023|Have you ever wondered how you can better understand your audience and create more impact with your marketing?

We have a lot to talk about.

ScrapbookDoor4 opinions and insight - our articles features and ramblings.

We explore performance marketing, AI, communications and optimisation.